DAY 2 Roundup – Tuesday 10 February 2026

Key messages from day 2

During today’s World Bank Group showcase session, critical minerals were framed as a development and competitiveness agenda for Africa, with success dependent on governance, infrastructure, skills, coordinated action, and effective partnerships.

There were several different sessions focusing on Guinea during the day. In the panel chaired by TDi Executive Chair, Assheton Stewart Carter, the speakers positioned Simandou as a unique example of multi-stakeholder cooperation, and possibly the blueprint for how to create mutual value for communities, companies, investors and government.

The Guinea Country Showcase session provided a clear call to investors around the Simandou programme, describing Simandou as a national economic transformation lever – not only a mining project. The speakers also presented ‘Simandou 2040’ – a national strategy to communicate Guinea’s priorities and how Simandou will translate into wider development outcomes.

In this afternoon’s session on building meaningful partnerships in critical mineral communities, delegates heard from the 2026 Community Voices winners on how truly resilient mining projects are based on open engagement, respect and inclusivity. This combination builds long-term trust and ultimately saves not only money, but more importantly lives, livelihoods and people’s futures.

In the morning’s session on whether global coordination can turn ASGM reform into real progress, the speakers discussed a new alliance set up as a motor for local development, better traceability, processing and enforcement – to help governments formalise the sector and deliver measurable progress.

Based on today’s discussions with downstream companies, the TDi team reports that, amid changing geopolitical dynamics, ESG and corporate sustainability are not fading away. Instead, they are evolving and being repositioned as key drivers within the industry.

See the detailed roundup below for more information on all of these sessions.

Stronger together in practice

During this session, Candice Jumwa, Mining Engineer from TDi’s sister organisation, The Impact Facility, chaired a panel made up of winners from the 2025/26 Community Voices competition.

The session looked at how meaningful partnerships can be built in critical mineral communities – examining lived experiences from regions across Africa, and identifying practical lessons and constructive models for community-company-state partnerships in the critical minerals sector.

You can hear more from Community Voices winners Nkosi Sibanda, Dr Matondo Estrela Garcia Cardoso, and Yamikani Jimusole in TDi’s Mining Indaba 2026 podcast series.

Key messages from this session included:

- Communities might not have the scientific knowledge of mining engineers, but they know about their land, air, water and the socio-economic landscape and have generations of Indigenous knowledge, so their insights are both valid and accurate

- Partnerships have not always been inclusive and truly engaging in mining projects, but that is starting to shift

- Communities are key stakeholders in mining projects – early engagement ensures key long-term success for all involved

- Listening with respect and acting with intent cannot be emphasised enough – this is the foundation of building long-term success.

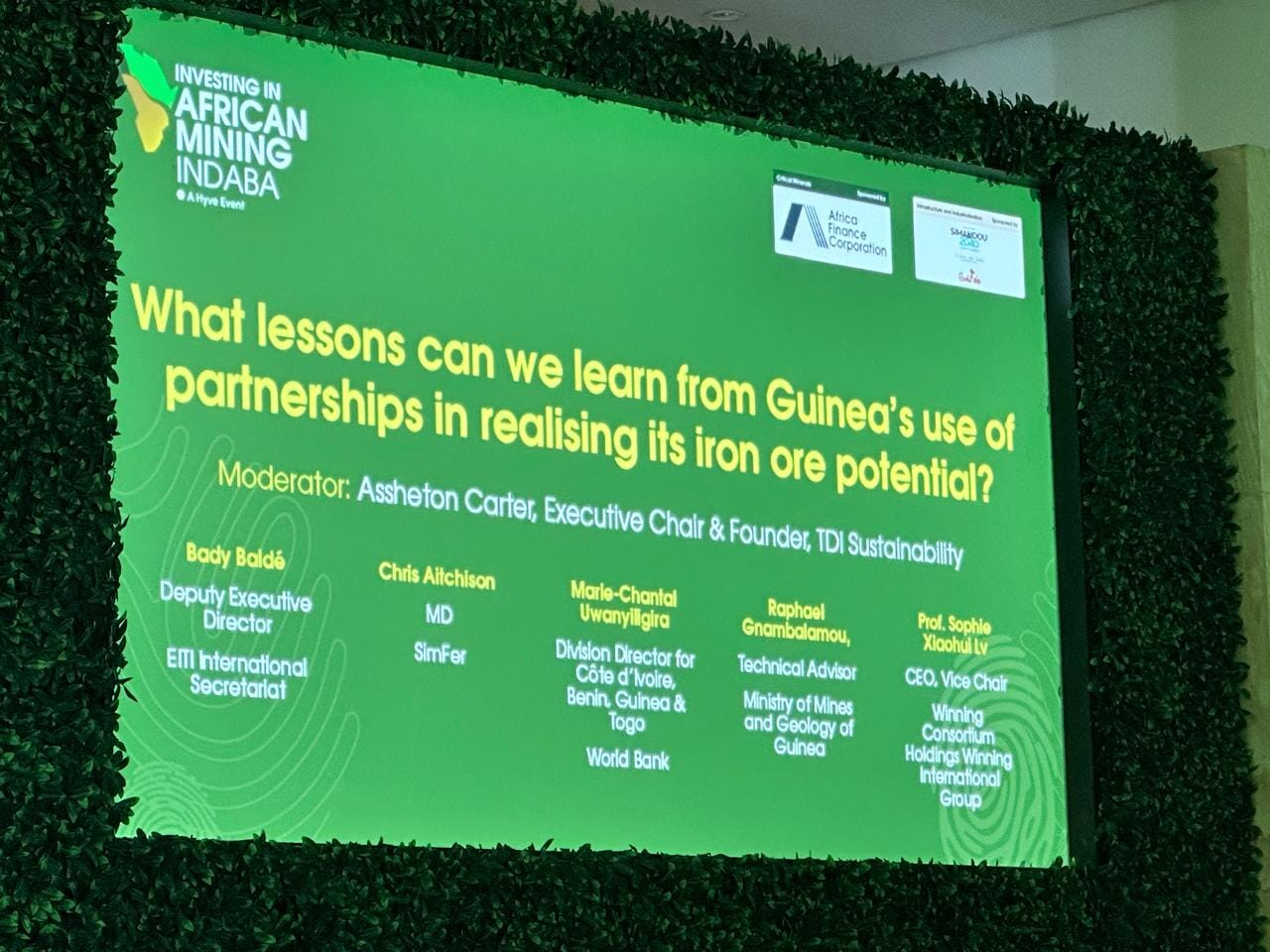

What lessons can we learn from Guinea’s use of partnerships?

Guinea holds some of the largest untapped high-grade iron ore reserves in the world, particularly in the Simandou range, a deposit that has long been seen as a game-changer for the global steel industry and for West Africa’s economic future.

But unlocking this potential has proven complex, with decades of delays, geopolitical entanglements, infrastructure challenges, and shifting global demand. This session chaired by TDi’s Assheton Stewart Carter, discussed the power of partnerships, and examined the lessons learned that could be extrapolated elsewhere.

You can hear more on Simandou from Safiatou Diallo of Rio Tinto, in TDi’s Mining Indaba 2026 podcast series.

Key takeaways from this session:

- The context of Simandou is complex – when many companies were pulling out (e.g. due to Ebola and political instability) – Rio Tinto was arriving

- The jury is still out – a lot has gone right but there are many factors still at play – so long-term success of these corridors is not signed and sealed just yet

- Collaboration is a competitive advantage – but action is the fuel – don’t wait for perfection, act now

- The importance of local beneficiation cannot be stressed enough – co-development is important, but co-ownership is crucial

- An ecosystem of auxiliary and ancillary businesses around the project is then key to success as a business model

- The timing of Simandou is a key aspect of the story – it is a 28-year case study in the making.

World Bank Group Showcase Session

Critical minerals were framed as a development and competitiveness agenda for Africa, with success dependent on governance, infrastructure, skills, coordinated action, and effective partnerships.

Demand outlook and Africa’s opportunity:

- Critical minerals demand expected to double by 2040

- Africa positioned as a major investment opportunity with potential for job creation and economic growth

Coordinated action and partnerships

- Strong emphasis that coordinated action is vital

- Partnerships needed across governance actors: governments, civil society, private sector and multilaterals

- Key enabling pillars highlighted: governance, infrastructure and private capital

Policy reform example: Malawi

- Gaps in legal framework identified and being reviewed to align with international standards

- Licensing regime under review

- Interest in engaging entities willing to collaborate with governments on implementation

What private sector operators should focus on:

- Skills development and investment in people were highlighted as critical, even alongside technological innovation.

Infrastructure as the constraint to value creation

- African mineral wealth only creates value if it can reach markets

- Africa was described as costing significantly more to move goods in and out – linked to infrastructure gaps

Mobilising capital – what works for whom?

- Junior miners need risk capital to perform

- Larger mining companies require stable, long-term capital

- Governments ‘make the rules’ and provide the most important backdrop for investor confidence

- ESG positioned as central to investment fitness and long-term success

Financial architecture and regional coordination:

- Call for change in Africa’s financial architecture

- Ghana’s gold buying programme was referenced as a positive example of coordinated mobilisation

Make-or-break phase and shared infrastructure expectations

- Mining in Africa was framed as being in a ‘make or break’ phase

- Multipurpose rail and infrastructure was described as essential

- If the private sector needs rail, water, electricity, there is an expectation that private sector actors should help build infrastructure that benefits communities as well as operations.

Day 3 Preview

In tomorrow’s round-up, the team will bring you the key messages from day 3, including panel sessions and discussions on:

- Regional collaboration v resource nationalism

- Local beneficiation and building partnerships for long-term value

- Financing infrastructure for regional integration

- Unlocking capital for explorers and junior mining

- Financing the gold value chain and integration into market ecosystems

Recap | Watch the day 1 highlights

A recap of the TDi team’s key messages from the Mining Indaba on Monday 9 February 2026 in Cape Town.