Proud to have worked with:

How our services support the investment and finance sector

Services

- Management systems

- Due diligence

- Risk mapping

- Second and third party audits

- Corporate sustainability strategy

- Human Rights Strategy

- Monitoring portfolio risks

- Impact investing

- Training and capacity building

- Community engagement and social investment strategies

- Creation of insights and reports

- Strategic communication

Management systems

- We create bespoke responsible investment and ESG due diligence management systems to support investment teams in making informed integrated risk assessments.

- We work with banks and funds to develop ESG risk appraisal tools and bespoke risk toolkits and appropriate monitoring and reporting frameworks for investment.

- We develop bespoke methodologies that help financial analysts make informed decisions when carrying out research and investments.

Case study> Denny Ellison ‘sin stocks’ research valuation methodology

- We develop performance evaluation criteria to support investment teams in assessing the financial impact of ESG initiatives in portfolio companies.

Due diligence

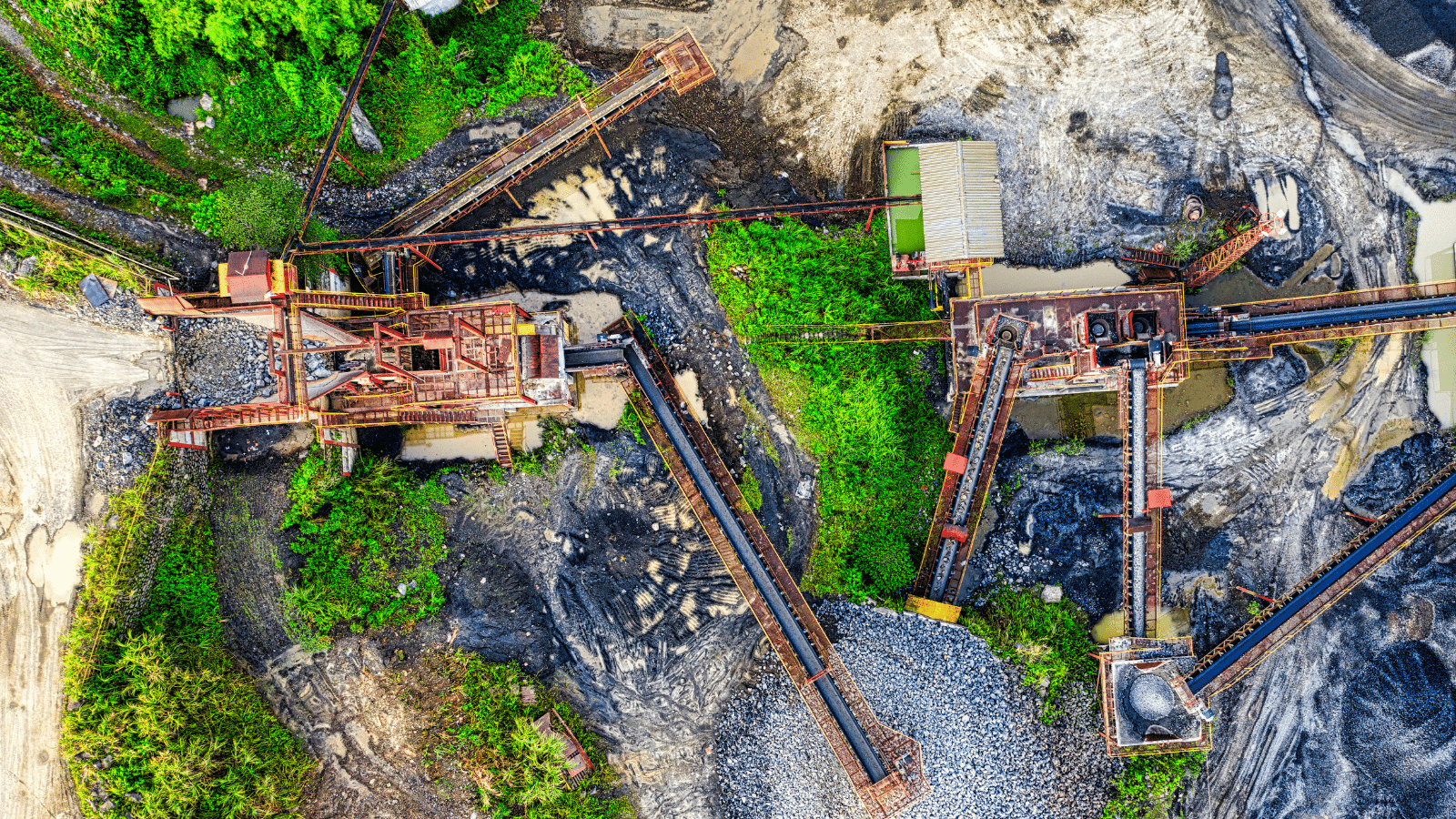

Conducting thorough due diligence is essential before investing in a new project or company. TDi carries out targeted asset-level assessments, site visits and stakeholder interviews, as well as country, commodity, company, sector and public issue risk analyses. This process verifies a company’s financial stability and compliance with international laws, environmental standards and social justice issues. Our expertise combined with our sophisticated digital tools make it faster, easier and more cost efficient to access the data you need.

Risk mapping

We carry out early pre-investment decision screening for ESG risk factors and categorical exclusions for fund managers.

We work with banks and funds to develop ESG risk appraisal tools and bespoke methodologies to help financial analysts make informed decisions.

Our consultants identify and analyse potential risks throughout your portfolio companies’ operations, to support responsible sourcing and adherence to labour standards, and to mitigate potential environmental and community impacts, safeguarding your portfolio against hidden ESG liabilities.

Our digital tools speed up risk identification, monitoring, compliance and due diligence.

Second and third party audits

TDi’s team of experienced auditors conduct assessments against IFC Standards and other financial institution safeguards – evaluating the performance, compliance and quality of portfolio companies, partners or service providers. We carry out audits and assessments against investor-specific requirements, supplier codes of conduct and a variety of key sustainability, traceability, chain of custody and responsible sourcing standards.

Corporate sustainability strategy

We offer a nuanced perspective on how institutional asset managers, including insurers, can effectively integrate sustainability factors into their investment frameworks, moving beyond a tick-box approach to genuinely impactful and resilient portfolios.

We work with governments and multilateral development banks to set their risk management strategies.

Case study> Supporting the development of a critical mineral strategy for a multi-lateral development bank

Human Rights Strategy

A strong human rights agenda will help you meet your stakeholders’ needs and expectations including creating social value, protecting human rights and managing regulatory requirements at both a firm and portfolio company level.

TDi helps private equity clients to develop robust human rights risk management approaches anchored around regulatory compliance, materiality and ambition. This focuses on the integration of human rights considerations into your investment lifecycle and decision-making processes from deal origination, through pre-investment screening and due diligence, to post-investment monitoring and finally, exit.

Private equity investors have considerable leverage to be able to push their investment companies to risk assess their human rights impact and take steps to mitigate negative impacts. By influencing their portfolio companies to be better businesses, the outcomes may be resulting financial returns and more sustainable business.

Monitoring portfolio risks

Credit, liquidity, operational and market risks can all affect a company’s ability to provide a return on investment. In addition, environmental and social risks within a company’s supply chain can all affect its valuation and reputation. TDi’s enhanced due diligence goes beyond credit checks – monitoring company, commodity and country-level risks, and providing adverse news and controversy management services.

- Search360° News Monitor | Near real-time risk identification to help p you stay on top of emerging supply chain issues related to your portfolio companies

- The Supply Chain and Due Diligence Tool | Quickly and easily explore the risk exposure of your portfolio companies

Impact investing

We understand the importance of aligning investment with corporate social responsibility goals. Our team of experts will help you to navigate the complex world of ESG and impact investing and evaluate the impact of your investments to help you make more informed decisions around sustainability.

Training and capacity building

We develop and run training sessions for executives and staff to provide clarity and context on ESG investment. Topics can include trends, standards and regulations, and market and consumer demands and expectations.

Case study: A training programme designed for equity research analysts

We can provide up to date information on ESG trends and developments and translate them into actionable improvements for funds’ capital deployment, investment activities, and oversight of portfolio companies.

We also assess and benchmark companies against ESG regulatory and voluntary standards. Our digital tools can help companies quickly identify for themselves which standards and regulations are most relevant to their sourcing, operations and ESG risk exposure.

Community engagement and social investment strategies

TDi develops social impact investment strategies that help companies to build social acceptance. We work with impact investors to evaluate the impact of their investments.

TDi works with impact initiatives such as The Impact Facility for Sustainable Mining communities, to provide a mechanism for companies to go beyond compliance, bringing about lasting change in the communities in which they operate, while simultaneously solving sourcing problems at an industry level.

Creation of insights and reports

TDi’s data analysts and responsible sourcing experts produce insight reports and data-driven research and analysis for a wide range of clients.

EITI case study (link) not created yet

TDi is known for its knowledge and data on ESG risks in minerals and metals supply chains. Get in touch with your research requirements.

Strategic communication

TDi works hand in hand with customers to help develop, systematise and disclose ESG performance. We prepare investor and customer reports to meet specific requirements and stakeholder needs. Our data-driven communications team can develop engaging and technically accurate internal and external communications strategies for funds’ ESG activities.

Latest trends

Due diligence

ESG factors are now a ‘must’ in due diligence and adverse news monitoring – providing information to investors to comply with regulations, make informed risk-based decisions, and identify opportunities to realise long-term value.

Commodity supply chains

Markets are seeing increasing fluctuations in commodity prices from interruptions to supply chains and geopolitical tensions. This includes physical commodities and hard assets such as minerals and metals, energy commodities, and agricultural products as well as financial instruments like currencies and bond yields.

Climate change and net zero

Increased regulatory and stakeholder demands have triggered many investors to search for ‘Paris-aligned’ and low-carbon/decarbonised deal flow without foregoing portfolio quality – developing strategies that reduce risk while grasping durable investment opportunities.

Clean energy transition

There is rising awareness of the ESG issues associated with the surging demand for minerals for clean energy technologies and land required for renewable energy projects. Find out more in TDi’s recent report: Material Change for Renewables.

Key resources

Read

Our report on the real value of sin stocks

The Real Value of Sin Stocks

"*" indicates required fields

Finance and Investment

Case Studies

Meet our investment and

finance experts

Your project

made possible