Impact investors missing out on huge potential of asm gold

BY CARLA NEEFS

The artisanal and small-scale mining (ASM) gold sector suffers from a dubious reputation worldwide among micro-credit financiers, impact investors and the private sector. There is a persistent perception that investing in and financing of ASM comes with a high level of risk. However, this perception is inaccurate and unfair. In this new series of blog articles, we aim to share important insights into this complex arena, and analyse the challenges and possible solutions.

TDI Sustainability and Solidaridad have partnered for this blog series, reflecting on insights gained from a recent research report commissioned by Solidaridad and carried out by the Global Initiative against Transnational Organized Crime; and TDI’s ongoing research in this field, funded by planetGOLD, as well as drawing from our first-hand experience through building The Impact Facility for Sustainable Mining Communities, enabling blended finance solutions for ASM. In this series of blog articles, we aim to share important insights into this complex arena and analyse the challenges and possible solutions.

The Mwandani women’s savings and loan group in Geita, Tanzania, has recently been able to start their own business in grinding ore thanks to an interest-free loan from the government to purchase the blue ball mill. They will be able to share the profits among the group members. These women miners take part in our Golden Line programme.

IMPACT INVESTORS

Impact investment has seen exponential levels of growth in recent years. There is a rising number of investors that prioritize positive impact over financial returns. This is in itself a positive development; however, there are very few examples of investments made into artisanal and small-scale gold. ASM gold does not easily fit within current investment frameworks and priority areas: impact investment tends to be directed towards agriculture, rural development, environment, and small and medium enterprises. Impact investors often have little or no knowledge on artisanal and small-scale mining and are not eager to become involved in untested business models.

A quote of an investor interviewed in the research by the Global Initiative and Solidaridad illustrates this well:

“The impact/social investing community is absolutely allergic to everything associated with mining because they think it’s so bad for the world. This is a strange approach among impact investors, given that they engage with a number of complex sectors and challenges. It’s not how they perceive any other problem.”

ASM miners using mercury to process gold ore. The use of mercury is still a common occurrence in ASM gold mining. The ASM sector is in dire need of formalization and formal investment to help eliminate this harmful practice.

In addition to possible adverse environmental and social impact, impact investors have concerns about their return on investment. It can take up to several years before investments start to pay off, and there is a risk of fluctuation in commodity prices and currency exchange rates. The lack of geological assessments and poor predictability of the life-span of the mining activities in ASM gold also increase the risk perception. Moreover, the obscure nature of the gold supply chain, as discussed in previous posts, is a reason for investors to lack confidence in engaging with ASM gold.

ASM miners in Peru wearing protective gear.

ASM GOLD HAS HUGE INVESTMENT POTENTIAL

Artisanal and small scale mining (ASM) accounts for nearly 550 tonnes/year of the gold production, or around 15% of the global supply (Metals Focus 2019). This represents a trade value of roughly 25 billion dollars. Investment potential is huge, supported by the following developments:

ASM gold is growing in importance, as the easy to mine large-scale global gold reserves are becoming depleted and global demand for gold is steadily increasing;

Many governments show interest in restructuring and formalizing their ASM gold sector to make it into a driver for national development, and are supported by international institutions like the World Bank, such as indicated in this publication on ASM in Ghana;

Many ASM gold mines lack access to formal finance and the ability to acquire effective technologies, resulting in low efficiency of their operations. Increasing investments in ASM gold would mean an increase in the profitability of the mines, and thus also a higher return on investment for the impact investors.

RISK MITIGATION

Considering the above, there would be a major win-win if we succeed in finding risk mitigation mechanisms to enable impact investment in ASM gold. Our research report with the Global Initiative reveals several risk mitigation options.

Impact investment shouldn’t start with careful selection of individual loan recipients, but with building trust and rapport with the local communities. It is also essential to foster the understanding of the current gold market and the (illicit) actors in it. Another strategy could be to strategically select the recipients of the loans; for example, experience has shown that women are generally much more diligent than men in paying back the loans.

EA$E: ECONOMIC AND SOCIAL EMPOWERMENT OF WOMEN IN MINING

In our Golden Line programme with partners Simavi and Healthy Entrepreneurs, Solidaridad implements the EA$E model to foster the economic and social empowerment of women in the mines and mining communities.

EA$E provides the women involved in the programme with the opportunity to join the women-only Village Savings and Loan Association (VSLA) groups as well as to participate in gender discussion groups and business skills training sessions. Men, as well as women, participate in training on gender equality and inclusivity. Women’s empowered economic position combined with greater awareness of gender equality among both men and women in the mining communities also reduces the risks of gender-based violence.

The women involved in the EA$E and VSLA groups in Ghana and Tanzania have shared that their economic and social position in the mines and communities has improved as a result.

For an example of our work in Golden Line, take a look at our mine profile of Elias Simba in Tanzania.

STAKEHOLDER COOPERATION TOWARDS IMPACT INVESTMENT

So far, there is very limited experience with impact investment in ASM Gold. The risk mitigation options identified in our research with the Global Initiative lead us to conclude that it requires close cooperation between different stakeholders. Impact investors need to collaborate with NGOs or other stakeholders that have long term relations with ASM gold miners and communities, and know the context of the (local) gold markets.

Our conclusions are in line with the research carried out by the Public-Private Alliance for Responsible Minerals Trade, entitled The barriers to financial access for the responsible minerals trade in the Great Lakes Region. This research identifies six design concepts for a financing facility to unblock access to finance for ASM, and concludes that for any type of solution to be viable, it is crucial that a bank or fund works together with a development partner to get the initiative tailored to ASM. Additionally, it is recommended to have a multistakeholder coalition approach involving relevant actors from industry, financial institutions and development partners in order to build trust and familiarity across the financial sector for new ways of working.

Over the past ten years, Solidaridad has built extensive experience in working with ASM gold miners – men and women – to improve their business and financial literacy skills. We have also been working on enabling ASM miners become a solid recipient for loans. This is indeed a process that takes years, and we invite impact investors to build upon this infrastructure and engage with us in impact investment programmes that improve the livelihoods of ASM miners and deliver a solid return on investment.

This article is the third in our blog series on artisanal and small-scale gold mining.

Read more about the work that The Impact Facility and the work they are doing bringing economic and environmental empowerment to artisanal and small-scale mining communities.

Read more about Solidaridad’s gold programme.

supply chain

supply chain

Re-defining legacy | Supporting companies and investors in achieving positive legacies in mining operations

3rd July 2025 supply chain

supply chain

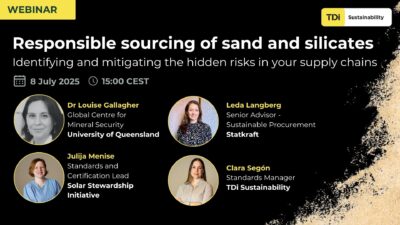

Responsible sourcing of sand and silicates | Identifying and mitigating the hidden risk in your supply chains

24th June 2025 supply chain

supply chain