CSRD Masterclass Webinar

Get your business CSRD ready

The Corporate Sustainability Reporting Directive (CSRD) is a pivotal piece of the broader EU Green Deal programme aimed at promoting sustainable economic growth and decarbonisation efforts within the European Union. In a recent TDi webinar, Agnes Davis, Martina Cappelli, and James Hollins delved into the intricacies of the CSRD, providing a comprehensive overview of its regulatory requirements, implications for companies, and the essential concept of double materiality.

From the origins of the Directive to the practical steps for compliance, this webinar serves as a valuable resource for organisations navigating the evolving landscape of sustainability reporting and disclosure, and sheds light on the critical aspects of the CSRD and its potential impact on businesses. Watch the video or read the transcription below to gain a greater understanding of the Directive and how you can get your business CSRD-ready.

Presented by TDi experts:

– Martina Cappelli, Senior Sustainability Consultant at TDi Sustainability

– James Hollins, Senior Sustainability and Responsible Sourcing, ESG Standards Audit Manager at TDi Sustainability

– Agnes Davis, Marketing Manager at TDi Sustainability

Watch the Webinar Recording Now

Read the Webinar Transcript Here

Agnes Davis

Today, we will cover the CSRD as an overview of what it is and what you need to know about it. We will be doing a deep dive into double materiality, an essential aspect of the CSRD, and James will cover that section. Martina will then be going into depth about what you need to do to comply with the CSRD. Then, we’ll be covering some of the tools we have at TDi that can support you and make it a bit easier to get everything together in the way you need to ensure you’re compliant, and then there’ll be some time for questions and answers. So starting off with Martina, what is the CSRD, and how will it impact companies?

Martina Cappelli

Thank you, Agnes. I’m going to start this CSRD overview with some contextual background on the directive, starting from where it originates. So CSRD is part of the broader EU Green Deal programme, which is essentially the European sustainable economic growth strategy, which itself is part of the EU Capital Markets Union initiative, which was designed in 2015 and revised then in 2020, with the aim that harmonising financial flows and capital markets at EU level as part of the EU Green Deal is the UN Sustainable Finance Action Plan. Designed in 2021 and still ongoing with gradual implementation within the sustainable finance action plan, our three main objectives are the reorientation of capital flows towards sustainable investments, the incorporation of sustainability-related criteria into traditional risk mapping and management practices at the corporate level, and then the fostering of transparency and longtermism. While it’s really the third objective that is most closely aligned with CSRD, it’s really a combination of the three that supports and promotes the goals of the EU Green Deal towards decarbonisation and carbon neutrality efforts. CSRD is backed by other cross-referencing and overlapping regulatory requirements, such as the sustainable financial disclosure directive, the new taxonomy and CES, and the corporate sustainability due diligence directive, which is getting approval slower. There, in this context, then CSRD is an important piece of a broader master plan at the European level to work towards more sustainable economic systems. If we look at the overview of regulatory trends, we can see both mandatory and also voluntary schemes for due diligence and corporate disclosure. We can see that there has been a substantial exponential increase over time, which is only set to increase further. As you can see, in 2014, the financial reporting directive was the precursor of CES 30. And we can see this in the transition itself towards CSRD. The naming itself of the directive has changed from being non-financial reporting-related requirements to clearly stating and embedding sustainability within the directive, which reflects the prominence and pivotal role of sustainability within corporate disclosure norms. Due Diligence regulations, including the German Supply Chain Act, the French Due Diligence and, as I mentioned, the Corporate Sustainability Due Diligence Directive have strong overlaps with CSRD in relation to risk mapping and mitigation and management activities at the value chain level, as well as on the school requirements included in those regulations. We’ll also see that the scope of CSRD also extends to value chain impacts. So there’s really cross-referencing and overlapping between doing the due diligence obligations and disclosure once, and what is foreseeable going forward is that these requirements, as I mentioned, are probably going to increase and not just at the EU level but globally as we are currently seeing in the US with the climate-related the disclosure requirements currently being under negotiation as well as ESG disclosure requirements in Asian markets as part of stock exchanges, regulatory changes for listed companies trading on in those markets. Thank you, Agnes. So now, looking at the definition of CSRD, what is the directive? What are the EU regulatory requirements adopted by the EU Commission in April 2021, which came into force in January 2023? The directive aims at expanding and improving upon the non-financial reporting directive by introducing a standardised, comprehensive, and consistent corporate sustainability reporting framework across the EU, and the deadline for member states to transpose the directive will be this July 2024 with some countries, such as France, which have already begun in implementation.

So what is the directive doing, what is it trying to do, and what are its key focus areas? So, the directive sets mandatory requirements for ESG disclosure on ESG risks, risks and opportunities and impacts on the society and environment and relevant stakeholders as well. As requires disclosure and therefore adoption of policy strategies and targets on much material ESG topics identified? What is it trying to achieve? It seeks to strengthen ESG disclosure and expand its scope both in terms of ESG topics and also in terms of companies required to disclose in order to promote greater transparency and accountability to enable better access and quality access to ESG information by relevant stakeholders, including investors, customers, civil society organisations and other relevant interest groups. Through a more harmonised and consistent approach with respect to the NFRD. In terms of the key focus areas, we can see that this closure will mainly cover business strategies and practices and resilience from ESG risks, including and specifically covering climate-related ones, then target and transition plans, value chains, and due diligence. As I mentioned, the directive extends to value chain impacts, although with some flexibility, especially in the first reporting phase, and then double materiality, which James will expand on later on.

The CSRD is going to impact a significant amount of companies. More than actually 50,000, companies will be required to disclose their ESG practices publicly. This includes both EU and non-EU companies, both listed and non-listed companies, as well as small and medium enterprises. And insurance companies and credit institutions. The thresholds for determining whether companies are in scope are based on turnover metrics as well as on the number of employees, annual revenues, and net sales. It is important to note that, as I mentioned, the directive extends to non-EU companies that either have subsidiaries or branches operating in the EU within certain net revenues and thresholds, and it’s estimated that around 10,000 companies non-EU companies will be impacted by CSRD, including 3000 US companies.

So, let’s take a closer look at the difference between the non-financial reporting directive and the non-financial reporting directive. What is changing? So, as I mentioned, the scope of ESG topics that will require this closure significantly expands the reporting framework, which I’ll expand on in a dedicated section. The European sustainability reporting standards require a much higher number of disclosure metrics and data points and, therefore, expand significantly on the amount of ESG topics coverage as compared to NFRD. The number of companies, as I mentioned, significantly increased with NFRD. Around 11,000 companies were impacted and now it is changing four times to 50 50,000. Double materiality will be a mandatory requirement under CSRD. Really important so companies will have to assess on their financial impacts as well as their ESG wants and report from those through the metrics defined in the reporting frameworks defined by the directive. And then interoperability. Interoperability with existing reporting standards. This is an important point. So, the reporting framework, the ESRS incorporate the main performance metrics from existing reporting standards such as the GRI, the recommendations of the task force on climate-related financial disclosures, SASB and other reporting frameworks with the aim of standardising and harmonising reporting practices across companies and enabling a better comparison of ESG performance in a more consistent way. And then there isn’t the overlap with EU taxonomy regulation. We’re requesting disclosure of specific investment-related metrics, impacts and correlations with the ESG performance. Companies in the scope of the EU taxonomy overlap with the ones in the scope of CSRD verification of ESG information to third-party assurance, which is now a mandatory requirement under the NFRD. Under CSRD, it is a mandatory and binding requirement. limited assurance will be required from the onset. So from 2025, for reporting on the 2024 financial year gradually, it will evolve, however, not before 2028, towards reasonable assurance, adding another level of complexity to the incorporation of ESG disclosures of part of as part of financial disclosure reports with NFRD. The disclosure was ESG disclosure, which could either be a standalone document or included in sustainability reports or annual reports. However, it was not required to include them as part of financial filings. Now, it has to be combined into financial reporting, and then electronic format submission is required in order to promote digitisation and also promote shareability of the information. Companies will have to submit ESG disclosure through a specific digital taxonomy and tagging system under the European single electronic format regulation. However, there will be some exam exemptions to this, such as for non-listed companies, which will be exempted from this requirement.

We can summarise it into four main pillars. How the CSRD is trying to will try to enhance and promote corporate ESG disclosure also having seen the differences within NFRD. It is going to increase the availability of ESG disclosure considering the broader scope of companies impacted then it will generate a more consistent and comparable approach to ESG disclosure by requiring the adoption of a single standard. The SRS that I mentioned and also sector-specific requirements as part of the ESRS standards, which are under development and then reliability through third-party mandatory assurance, which we’ll put some pressure on companies to ensure a better quality of information as part of their data gathering and collaboration processes and then promoting it will promote accessibility and shareability of information to the electronic format in the submission that I mentioned.

We’re going to take a quick look at the main set of key areas that I touched upon earlier while expanding a bit on the underlying requirements and implications for companies. So, the first point, and really a core and integral component of CSRD, is double materiality. I’ll let James go to the specifics; however, what it will require is an assessment of our financial risks and opportunities within his ESG topics in the short, medium and long term. Therefore, companies will need to either update and upgrade their current materiality assessments to include this two-sided analysis or ensure that they set up the processes in place to map out financial and ESG risks and relevant topics. And then, on the long-term outlook, CSRD extends the time range for impact analysis to cover also medium and long-term impact, and therefore, they will need to review and upgrade the risk their internal risk management and control system to structurally monitor over longer timeframe risks and opportunities and then supply chain you did due diligence as I mentioned yesterday extends the scope to the supply chain. Companies will need to report on potential risks from activities on their supply chains. Therefore, this will require a more comprehensive approach to supply chain risk management and risk assessment practices. Although there will be some flexibility, as I mentioned in the first years around the supply chain disclosure and also another point to make is that the supply chain performance metrics will focus mostly on GHG emissions performance for for the supply chain.

However, it still required a full ESG risk mapping activity. However, in terms of the disclosure requirements there, the focus is mostly on GHG emissions and carbon footprint, and additional metrics are more on the qualitative side as the ESRS have accounted for the complexity of the data gathering process and requirements at value chain level. Then, on carbon footprint and climate risk management and strategies, companies will be required to adopt the strategy in line with the 1.5-degree pathway to monitor their carbon footprint as well as to assess and monitor their climate-related risks and opportunities in line with similar metrics to the TCFD and CDP and other climate-specific reporting frameworks, and we’ll have to conduct scenario analysis also to ensure coverage over a long, long term timeline quickly expanding on the remaining key areas.

With material topic reporting and targets companies will need to report on performance targets action plans and, therefore, will have to either set up the required data collection processes in place or align the current ones to ensure that they’re able to meet reporting expectations and then EU taxonomy. Reporting. As I mentioned, the overlap with the taxonomy classification system will require companies to assess the greenness of their economic activities through reporting on specific financial metrics to assess the ESG impact on this and vice versa. Limited assurance requirements as a question assurance will be mandatory, and this will require that the data disclosed can be audit-ready to avoid penalties in sanctions in this sense. Hence, the pressure on the quality of information and disclosure will be much higher as compared to previous norms, and then integration of ESG reporting with the CSRD ESG disclosure information has to be part of the Advent to be combined with financial-related one, then the reporting governance and structures will need to be adjusted to reflect on this on this requirement. I will now hand over to James for a deep dive into double materiality and the approach to take on this topic.

James Hollins

Thanks, Martina. This term, double materiality, which is fundamental to CSRD, gets talked about a lot. We’re going to provide a quick step-by-step guide on how to conduct double materiality for a company, but essentially, companies use double materiality assessments as a way to consider both the company’s impact on the environment and society. And the sustainability topics impact the company’s ability to create financial value. So, really, it’s these risks and opportunities viewed as a two-way impact. Applying double materiality allows an organisation to compare sustainability topics based on those that have an impact on the organisation and those that have an impact on the environment and society. So, in the realm of sustainability, the word materiality refers to the significance of environmental, social and corporate governance issues to an organisation and its stakeholders. When we talk about double materiality, we go one step further. By introducing two distinct dimensions, this inside-out view of the impact materiality dimension prompts companies to consider their sustainability topics through the lens of how their operations impact people on the environment, and then this outside-in view, the financial materiality so as I mentioned, the focus shifts to how the ESG topics present financial risks and opportunities, opportunities for the organisation so it’s really an outside-in view. And really, the first step for conducting double materiality is understanding the context and value chain, and you cannot deal with double materiality without mapping your company’s value chain, identifying key stakeholders, including entities both involved upstream and downstream of your activities and assess who should be involved in the materiality assessment. So this really is the starting point for conducting this. Essentially, leveraging existing sustainability documents, understanding climate risks, looking at human rights, due diligence, and assessments to inform your approach, really starting with this, the benefits are that it’s fundamental. It’s the foundational step to beginning double materiality, and it provides a tailored and informed materiality assessment, aligning the process with your company’s specific operations impacts, and really it streamlines the whole process from here on in sort of building on existing knowledge to enhance efficiency and effectiveness and sustainability reporting. So everything from this point onwards is determined by step one.

Step two is to propose topics. I want to begin with an exhaustive list of potential ESG topics that could impact or be impacted by your company’s operations. What I’ll say for this is that the European Sustainability Reporting Standards (ESRS) topic list is a good starting point. That is not designed to be exhaustive. It’s it’s limited, but it’s a really good starting point. To understand the potential risks and opportunities. This in itself should be supplemented with insights from industry reports, industry expert sustainability frameworks, and competitor analysis to really build on the scope of the ESRS topic list, which Martina is going to present after this, and she’s going to go through that ESRS topic list. But that’s really good starting point. And then it should be supplemented.

Step three is to engage stakeholders. You can utilise various methods here to engage stakeholders to get feedback. On your proposed topics, surveys, focus groups, one-to-one interviews, and talking to industry experts. Covering a wide range of groups from different sectors is important. And adding background is fundamental here. There’s there’s plenty of guidance out there on how to conduct this, but this is a really important step into supplementing your ESRS list in step two.

Step four is to finalise the topics, so you can refine your list of ESG topics based on the stakeholders’ feedback, prioritising them by their significance to stakeholders and their impact on your business in collaboration with key internal decision makers. I think this is really important because finalising topics with stakeholder input ensures your sustainability efforts are focused on areas of greatest importance and impact. It allows a clear focus on topics that are relevant to your organisation in the impacts, risks and opportunities assessment, what we call IRO assessment.

Step five is to provide a detailed analysis for each prioritised topic to identify specific impacts, risks and opportunities, analyse internal data that you’ve collected, look at industry benchmarks and how they’re dealing with these risks and opportunities, conducting value chain assessments, insights from your stakeholder engagement previously in step three, this is all incorporated at this stage and precisely identifying these IROs allows for targeted sustainability strategies, effective risk mitigation, opportunity, leverage and highlights areas for innovation and competitive advantage.

And then, in step six, which is the scoring part of the will materiality, you develop a consistent scoring system for each iron based on severity and likelihood using both the qualitative data and quantitative data you’ve collected and consider where the arrows sit within your organisation or the upstream or downstream in your value chain, or do they sit actually at your entity level? Developing a robust and systematic scoring process provides an objective basis for prioritising these issues enhancing strategic decision-making and resource allocation. And it’s really important that this scoring mechanism is accurate because it determines what fundamentally needs to be prioritised.

And then you assess your results. So the penultimate step is to aggregate and analyse the scoring results and set thresholds for each to determine which IROs and, therefore, topics are material to you. So this is where the material aspects start to take shape. These thresholds can be both qualitative and quantitative. However, once you’ve determined the material topics, ensure you document the rationale for these decisions for inclusion in your sustainability report. So, this inclusion is really important. There has to be a robust rationale for why they’re included, and the previous steps lead to that. Yeah, so align your identified material and IROs with the ESRS topics that we’re going to talk about after this with Martina, but they provide the ESRS metrics and disclosures, and you should consider the specifics of each standard and its relevance to your business. It’s recommended these are tracked with software to ensure scalability, security, collaboration and efficiency throughout the process. Integrating the findings of the ESRS metrics ensures compliance with CSRD requirements. So, this compliance part is fundamental to CSRD. Ehat it essentially looks like is this double materiality overview. You’ve probably seen these double materiality assessments looking like something on the right-hand side here, with the top right being the most material to the organisation and those going down towards the left-hand side being less material and, therefore, the priority that starts to begin with the top right-hand side and those topics that you’ve determined to be material to the organisation and those that are material to the impact on society and environment. Hence, the double materiality approach here. Martina is going to talk about the ESRS’s topics next, and as I said, these topics provide a good starting point for the identification of risks and opportunities.

Martina Cappelli

Thank you, James. I’m going to provide an overview of the ESRS which are the reporting standards required under CSRD, making them mandatory to use under companies in scope. Just some contextual and background information on the standards. They were developed by EFRAG, which is the technical adviser appointed by the EU Commission at the time the directive was adopted on April 20 2001, which required several negotiations and a multi-year process. Following publication last June and a four-week consultation period, they were adopted last July through delegated acts. So, as we can see from the graph, there are currently post standards. This is called the sauce. This is the so-called first batch per set of the ESRS standards. Why the first set? There’s going to be a second one as a sector standards list and set of specific sector-related standards. The US currently identified 40 sectors. The first one, oil and gas, has already been released, and these 12 standards, which have been released by EFRAG, consist of two cross-cutting standards, ESRS one general requirement and ESRS two general disclosures with double materiality being included under yes yes 110 topics specific cross-sectoral standards including five environmental standards for social and one governance standards. Overall, more than 84 disclosure requirements are included in the ESRs. These include both qualitative and quantitative information. It is estimated that one-third of disclosure requirements will be quantitative, whereas two-thirds will be qualitative. As I mentioned, this also extends to disclosing value chain impacts both upstream and downstream, specifically on GHG emissions performance, as I mentioned, and man in terms of mandatory requirements under ESRS. All requirements are included under general disclosures. ESRS two are mandatory for all companies in scope. Other requirements are subject to materiality assessments, and companies will then report on those material topics identified through materiality assessments. Other types of disclosures will be subject to voluntary disclosure.

The Commission has introduced flexibility in terms of reporting requirements, given the complexity around it, by allowing companies to meet specific disclosure requirements in your one and also allow smaller companies with less than 750 employees to omit a wider number of disclosures in the first two reporting cycles. In terms of upcoming developments and additional resources that will be released by EFRAG. As I mentioned, there are going to be sector-specific standards. Now, this has already been delayed for some time. As of today, the release of two sector standards is expected in June 2025. The applicability of sector-specific standards is expected to start in 2026. EFRAG is also going to release what are called ESRS for SMEs, and it has already produced the specific guidance for disclosure of supply chain metrics impact metrics, as well as guidance on how to the guidance document how to conduct the double materiality, and it is also under development technical guide guideline for implementing machine readability of ESRs statements.

So, in line with your digital taxonomy that I touched upon earlier, this is kind of an overview of the ESRS. The ESRS incorporate several performance requirements from other existing reporting standards taking the topical standards indicators as a reference, then expanding on them. Then materiality assessment requirements include sector-specific standards tclp the carbon disclosure project, including specific disclosure of climate risks and opportunities, financial impacts strategies, Senate and scenario analysis and carbon footprint calculation. Clearly, companies which are already experienced with such reporting standards and frameworks and are already subject to an NFRD reporting in line with the NFRD or other reporting obligations or voluntary frameworks have an advanced advantaged income complying with the CSRD given the complexity around it.

Let’s take a look at what will be required of companies to put in place to ensure compliance with the with CSRD. It will be a journey for those who would have to put these processes and systems in place from the onset and might not be experienced with ESG disclosure. For those who are already reporting, it will still include a significant amount of complexity in reviewing and expanding on the existing processes to ensure that yesterday’s requirements are incorporated as a starting point. It is essential that there is a commitment from the board and management to the implementation of CSRD and ensuring that there is full knowledge of what yesterday implies and how it will impact the company and also a clear understanding of what will be the consequences of noncompliance. Now, CSRD has left the member states to define sanctions and penalties for non-compliance, so this will be defined more specifically when the director is transposed to the national level; however, it is expected that there will be significant fines and potentially also another type of liabilities for not complying. Another key point is internal capacity, which is building and training internal staff to ensure full knowledge and capacity on EU regulations. I also included the other regulations that I mentioned, such as the taxonomy which might overlap with CSRD to ensure synergy in relation to requirements and disclosure efforts around them. And ensure full knowledge of the ESRS standards also. It is key to set up a robust internal control and due diligence system for ESG risk management by and or reviewing the existing one to incorporate those criteria that are required, including extending control controls at the value chain level and then establishing a cross-functional data collection system. This is fundamental. It is really important to set up a data gathering system, both internal and external, and ensure that the quality of information is aligned with the quality of financial-related information. Set since they will be combined in the same report and then ensure cross-departmental uncomfortability and collaboration. A high number of departments and functions will be involved in the data collection process, and it is essential to establish roles and responsibilities within departments and ensure full collaboration across them in the data collection and measurement and corroboration validation process. And then lastly, the adoption of ESG policies, strategies and targets on those material topics are identified. This is with specific reference to the adoption of GHG strategies and transition plans in line with the 1.5-degree pathway that was touched upon earlier. So essentially, as I mentioned, it will be a journey and will require several actions to put in place. The sooner, the better, in a way, as the implementation phase is fast approaching, and it will require a significant amount of effort for those who will have to start from scratch.

We’re going to look quickly at the timeline for reporting and implementation. So starting in 2025, for the financial year for reporting on financial year 2024. Companies will need to start reporting yesterday’s requirements and all companies in scope will have to be compliant by 2029. In 2025, the first group of companies to start reporting on 2024 will be companies already subject to NFRD and then after that, in 2026, all other large companies now currently subject to NFRD. Small and medium enterprises will start in 2027, and non-complex credit institutions and insurance entities will start in 2028. Non-EU companies will have to report in 2029. So, this is kind of an overview of the implementation phase across companies in scope. I am now going to go over again to James for an overview of our services and solutions and how we can help in the process of CSRD compliance.

James Hollins

TDi consulting, auditing, and data provides bespoke services within the sectors and bespoke strategies and management systems for the design and development of these new standards that shape the whole industries that we work with. An important aspect of this is providing these bespoke reports to clients. We are experts in ESG risk impacts and opportunities. We work with many of the world’s largest companies on these topics, from OECD reports to working with national legislation on specific legislation itself.

Alongside this, we have a vast library of data, which we are turning into a risk platform currently. So that this data is more accessible to clients in a cost-efficient manner. We currently provide a number of risk indices to clients. But what we’re currently doing is developing a risk platform where all of this will be online for clients to be able to see specific risks and opportunities within their sourcing practices. Alongside this, we have mapped standards and regulations to allow companies to quickly identify those standards that are most relevant to their sourcing, but also those standards which mitigate their specific risk exposure. This incredibly important to know your double materiality when it comes to these IROs and to understand these mitigation aspects of the standards that your suppliers, etc., may have. So this tool in itself, the iCAT tool – the Integrated Compliance Assurance Tool – maps this into an extremely granular level to the very minute levels of detail for both the standard itself and also the regulations.

Agnes Davis

Thank you, Martina and James. Lots of details are being covered there. So, just a couple of questions quickly for me; I know that we haven’t got very long, but just to make sure we’ve got everything, I just wanted to ask how frequently shouldn’t undertaking updates has been double material around materiality assessment.

James Hollins

In terms of updating double materiality – once you’ve done it, it is required on the CSRD to be updated annually in order to account for any new impacts, risks and opportunities. What I’ll say alongside that is you don’t need to start from scratch every single year. You just need to update it. So it doesn’t have to be entirely fully fledged that will materiality every year, where you would need to do a fully new double materiality every year is if there were significant mergers and acquisitions within your business, if there are significant changes to your core suppliers, or if there have been significant changes to the risks throughout your value chain such as major world events, for example, which may significantly impact your value chain. That’s where you would need to do an entire new double materiality for that year. Otherwise, you can build upon the previous year’s ones.

Agnes Davis

Thank you, James. Another question has come in: What is the impact on UK companies in terms of record of reporting specifically? Is there a similar directive to this that has to be followed for UK companies? Or will it become the case that UK companies will only come under the scope if they have one of those external companies that might be under scope? What would be the UK impact?

James Hollins

Yeah, they would potentially come under what’s called a third-country company. These subsidiaries operate in Europe; otherwise, there is what Martina talked about in terms of the timeline there. There is also a potential that the UK would adopt European legislation, so you can just be absorbed like other ones potentially are.

Martina Cappelli

Yeah, in terms of the impacts on the abilities of non-compliance for UK companies, just as with other countries, these are still being defined. France is the only one that has transposed the directive to date. It has set penalties, fines are non-compliance – more than 75,000 euros and up to five years imprisonment for board members – in case of non-compliance. They’ve been very strict. Other countries are still in the process of transposing it. There, there’s still no clear guidance on sanctions and penalties for non-compliance by non-EU companies. We’ll make sure to include that in the revised version of the FAQ guidebook that we’ve produced so we can follow up with the details as soon as we have more information on this.

Agnes Davis

That’s really helpful, and it is a nice segue into the additional resources that we have available from TDI. So, if you go to the TDA website, we have a section, which is the knowledge centre on the toolbar, and you’ll find links to our CSRD support materials that we already have. There’s a very extensive blog, and there’s also a downloadable FAQ Guide Book, which, as Martina says, will be updated as new information comes in as this unfolds over the coming months. Thank you.

supply chain

supply chain

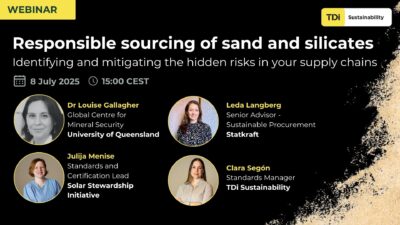

Responsible sourcing of sand and silicates | Identifying and mitigating the hidden risk in your supply chains

24th June 2025 supply chain

supply chain

Responsible sourcing of critical minerals for the clean energy transition – The Asian context

6th June 2025 Industry Initiatives

Industry Initiatives