Webinar: ESG for Buy-Side Equity Research

Growing Pressure to Integrate ESG into Investments

Over the last few years, Asset Managers and Equity Research Analysts have been under growing pressure from clients to integrate ESG into their investment process.

This, combined with increasing regulations and the general recognition that ESG factors can affect risk and returns, has led more asset managers to include ESG considerations into their fundamental research and investment approach.

The ESG Challenge Facing Equity Research Analysts and Asset Managers

However, integrating ESG into equity research has become a real challenge, forcing analysts to:

· Learn ESG vocabulary and know about the relevant regulations;

· Make sense of ESG research;

· Identify relevant ESG issues, assess their materiality and quantify their impact on financial forecasts and valuation;

· Assess the risks, especially around bad ESG press on the companies in their coverage; and

· Cater the analysis to specific sectors.

A Comprehensive ESG Training Programme

As an established training provider focused on fundamental equity research, Denny Ellison has partnered with ESG specialists, TDi Sustainability, to develop a comprehensive training programme focusing on ESG integration into equity research.

What Makes this Training Programme So Unique?

1. Through this training, we take a deep look at ESG integration on a sector-by-sector basis, covering 10 different sectors, from Industrials, Oil & Gas, Metals & Mining, Transport and Autos to Chemicals & Construction, Consumer, Retail, TMT and Pharmaceuticals.

2. Rather than preaching a specific way of conducting responsible and sustainable investments, we equip Asset Managers and Equity Research Analysts with the tools and frameworks to integrate ESG into their long-term, fundamental research; and

3. Each course is taught by a sector specialist equity research trainer using the expertise from our ESG partner, TDi Sustainability, who are at the cutting edge of sustainability knowledge and solutions.

Learn more in this webinar

In this webinar, Denny Ellison CEO, Eveline Varin, was joined by TDi CEO, Assheton Carter, to discuss the key hurdles that analysts are facing, and present solutions to fill the skills gaps.

You should watch this webinar if:

· You want access to experts with very deep knowledge into equity research and ESG impact on the ground;

· You have learned about basic ESG risks, and are ready to gain a deeper understanding of ESG integration for 10 different sectors;

· Rather than a generic solution that might not fit your needs, you are looking for detailed tools and frameworks to integrate ESG into your fundamental research.

Watch the webinar recording now:

Read the webinar transcript:

Agnes Davis

Thanks again so much to everybody for joining us today. My name is Agnes, and I’m the Marketing Manager at TDi Sustainability; and today, I’m joined by Assheton Carter, who is the CEO of TDi Sustainability and also with Eveline Varin from Denny Ellison. So we’re really, really pleased to be talking today about ESG for buy-side equity research. And there’ll be opportunities for questions and answers as we go on through the session. Please do feel free to drop your questions in the chat, and I will make sure that we follow up with those as much as we can. A reminder that today’s webinar is being recorded so that it can be used and shared again in the future; we will produce a link for that within the next week or so on the TDi social media channels. We’ve got LinkedIn, Instagram and YouTube, and there’ll be a full transcription available on the TDi website as well for accessibility purposes. So keep an eye out for that. We’ll be talking for about half an hour today, and then with a bit of time extra for questions and answers. And before we get started properly, I’d really love to just ask the panellists to introduce themselves so we can hear a bit more about their background and expertise. So maybe Eveline, could you start us off by letting us know a little bit about Denny Ellison and your work with that?

Eveline Varin

Thank you very much for inviting me. So we are an independent research and training provider. We’re based in London, and the company was founded in 2010. We specialise in equity research, and we are a team of 10 experienced analysts, each with more than 15 years of experience on average. We all work with leading investment banks and asset management firms. In our training programme, we cover technical skills such as financial analysis, modelling and valuation, how to build a strong investment case, and how to write impactful equity research reports. We also cover soft skills such as communication and presentation skills. So I think the programme is really a great way to equip research analysts with a strong baseline of technical skills and upscale the research produced in the investment industry.

Agnes Davis

Assheton, would you like to introduce your work with TDi?

Assheton Carter

TDi Sustainability. We’ve been around for about ten years now. And we are a sustainability consulting firm with expertise in ESG risk assessments and due diligence. And we work in multiple sectors and across the value chains, with the investment and asset management sector, of course, but also with the corporates along the value chain right from Fortune 100 companies down to SMEs in different continents in the world. We work from mine to manufacturer, from farm to pharmacy, understanding the relationships between the companies and where they are most exposed regarding ESG concerns and all the mitigating actions that can be taken to address those ESG risks. And so we’re very pleased to be working with Denny Ellison for a couple of years now to bring together this fundamental research and expertise that Denny Ellison has, with our ESG competence which we feel is a very good package to enable the analysts in asset managers on the buy-side to face the kind of fast-changing world of investment.

Agnes Davis

And just to sort of reiterate the background of the webinar and the purpose of getting together today: we’ve been putting it in the context of the fact that over recent years asset managers have been under pressure from their clients to integrate ESG into their investment process. And it’d be just good to hear a little bit more about why you think that is maybe Eveline – we could start with you.

Eveline Varin

Yeah, I mean, the initial driver of ESG integration really came from the clients of investment funds. There was a growing awareness and interest in ESG issues among investors. Investors also realised that their investments could really make a difference and, together with that, the mandate for greater transparency on how their money was invested. This demand has led to an outperformance of ESG funds before and during the COVID pandemic specifically, but in the last few years, ESG funds have gone through a notable correction given several allegations of greenwashing specifically. So as a response, we have seen quite a clear acceleration of the regulations around ESG performance for companies. But the drivers have now evolved, and we’re seeing a greater recognition among asset managers that ESG factors can really affect the risk and returns of their investments.

Agnes Davis

Assheton, from a TDi ESG perspective. It would be good just to hear how you feel the landscape has been shifting over recent years.

Assheton Carter

I mentioned in my earlier remarks that TDi is a purpose-driven consultancy. So our fundamental belief is that the business sector can be a driver for sustainable development. But what I think is kind of more fundamental at the moment is that the regulatory landscape has really accelerated in terms of the ESG mandates that it’s placing on asset managers and the corpus in which they wish they invest. And these regulations have multiplied in an effort to combat greenwashing and to standardise best practices, and they really are becoming very sticky in terms of their durability. We’ve done a recent analysis of the EU, the so-called Brussels effect, meaning that the EU is becoming the standard bearer for ESG regulations. And there are many kinds of overlapping regulations, which can be very confusing, whether that’s critical raw materials, the sustainability reporting directive, the due diligence directive, the packaging and waste directive, the battery regulation, and so on. And so asset managers and businesses are being kind of forced to engage and prove their own credentials, and this can be a huge burden to navigate these different regulations. And I think another thing to bear in mind is that these regulations now are not just about due diligence, which asset managers understand well, but they also have implications for the movement of goods. So the regulations have been shifting in the US and in the EU to say that in some supply chains, if there is the possibility that goods are moving across borders and don’t meet the expectations of certain jurisdictions – they will be warehoused. This is the thing that asset managers now need to better understand about their portfolio companies. And not only the regulations placed on them but also the regulations that have implications for their investee companies as well. So we’re shifting from the idea of ESG being something that is nice to have and part of the ethical values of a company to something which is becoming increasingly mandatory and therefore has a compliance risk attached to it.

Agnes Davis

Would you say there’s any evidence that ESG impacts the financial performance of companies and their share price? Is that something that you’re seeing more and more of?

Eveline Varin

There is an increasing number of studies on this subject. But unfortunately, there is no clear consensus due to the different methodologies that are used and also the lack of track record because all this is quite new over the last few years. But when looking at ESG and share prices, specifically, an interesting finding is the impact of ESG-related public issues or bad press on share prices. And if a material ESG issue has been widely covered, the market reaction can be quite material and typically, negative news also gets more reaction from the market than positive news. So this is independent of whether the ESG news has actually got a financial impact on the company. So we’re really talking even more about market sentiment impacting the share price. On the impact of ESG on the financial performance of companies and based on the limited track record, I think the only conclusive finding is that, in general, companies that have stronger fundamentals – a stronger balance sheet and higher profitability – are more able to spend on ESG and would rank better. But there is no empirical evidence of the opposite. There is also a general acceptance that if a company engages in ESG initiatives, it inherently has stronger risk management policies and is perhaps more innovative, which itself bodes well for stronger financial performance.

Assheton Carter

I think Eveline has it right in how linking ESG performance to financial performance has been evasive in terms of coming to a common methodology and understanding of it. Also, she is totally right that if a company is good at managing risk, generally, the ESG is on the radar, then the fundamental practice that they have can equip them well for doing that. I think there are some some some exceptions to kind of financial performance, especially when it comes to the natural resource companies where they have to work upstream in the environment when working with local governments and communities is extremely important, especially if that has the possibility to interrupt cash flow. But generally, I think that we’ve got to kind of help asset managers really understand what those risks are, how to incorporate them alongside other fundamental risks.

Agnes Davis

Am I right in thinking that TDi has a tool that helps support companies with that?

Assheton Carter

Yes, TDi and Denny Ellison developed a tool, and we published a paper a year ago where we looked at what the impact of adverse news is over the last ten years and what that means for the valuation and implications of them for the investment strategy alongside that. So yes, we again have combined the two organisations’ core skills in data analysis on ESG and also then the valuation methodology to come up with a more kind of robust way to look at valuations and share price.

Agnes Davis

So how have asset managers been integrating ESG into the service process?

Eveline Varin

From what we have seen, ESG integration is done quite differently by each asset manager. So the first decision that they tend to make is whether they want to engage in the highest degree of commitment in ESG, which is called impact investing. This is when the fund will accept a lower risk-adjusted return and prioritise the positive impact on the environment or sustainable goals. For example, the level of commitment below that would be sustainable investing, and then the one below that would be responsible investing, which I think the latter one is probably the most common one. So when it comes to responsible investments, we’re going to have quite a broad spectrum of implementations. Some asset managers will exclude some sectors from their investment universe. Others will integrate ESG into their fundamental forecasts and evaluation. And they may also create their own internal ESG scoring on the companies that we cover rather than rely on external providers. And then finally, there are some asset managers who simply view ESG as another area to widen their information set to make investment decisions. So there’s quite a broad spectrum here. TDi Sustainability and Denny Ellison have worked with asset managers to support all these different strategies and even the combination of those strategies. So our job is really to develop a fit-for-purpose training programme to match the client’s approaches and different approaches.

Agnes Davis

What are the challenges that equity research analysts face when they’re integrating ESG into their research?

Assheton Carter

I think one of the things that we’ve found is that one of the core issues is familiarity. We’ve been working with the corpus on ESG for 20 or 30 years and this language is understood by them but is a fairly new and immature world for asset managers and it can be very confusing. The biggest challenge is how this is relevant for the asset managers, how they implement it, and what are the implications of ESG issues in their portfolios and valuations. And I think one part of that is trying to understand the difference between an adverse news event and a particular impact on the ground, and then bringing them back to what is that in terms of the actual upside or downside risk for the portfolio companies. And that takes more than just a data point that takes context. You need to contextualise some of these events in your portfolio and understand what that means if you’re at risk of making a misstep in terms of your decisions. That’s what Denny and TDi can do together, combining the context of these ESG risks, getting the right data points, and understanding how that fits into the valuations of the portfolio and what to do about it.

Eveline Varin

It is a new vocabulary set for fundamental equity research regarding ESG. I think what we have seen with the current client that we are servicing on the training side is the difficulty to quantify some of those ESG factors in terms of how material it is to financial forecast, to valuation or to the equity story itself, and materiality is quite important. And that’s going to base their investment decision and investment recommendations. Understanding the vocabulary and being on top of the latest regulations is really important. And the last point is quite crucial for equity research analysts: how to cater the analysis for each of the sectors. The ESG issues are not the same for the consumer, industrials, pharma or the oil and gas sector for some sectors. ESG is a major risk where companies have to diversify their product offering and change their whole business positioning. And for others, it is actually an opportunity and a driver of growth. So differentiating between sectors is important, and we can’t say one ESG issue is the same for all sectors because there will always be differences.

Agnes Davis

Yeah, that’s interesting. So you need to have a tailored approach. So you’ve both been pooling your expertise to launch a training programme on ESG integration specifically designed for equity research analysts and portfolio managers. And I hear the feedback from large asset management firms has been very positive so far. It would be interesting to hear how the training has been addressing some of those issues around ESG for the investment community, and how you’ve been managing to tailor the sector issues.

Assheton Carter

We’ve been working on ESG risks for over ten years now, and that depth of knowledge is really important. We’ve got to make that accessible and practical. So it’s the simplicity on the other side of complexity that we bring to this. In terms of the training package and how we present those risks, we can still do that in the language of the asset managers and the analysts. But behind that is a data-driven model which has been developed over the last five or six years. So we have the depth of the knowledge about ESG risk, but the way that we present it is very practical, pragmatic and simple. We also don’t preach a certain way to integrate and quantify ESG into investment decisions. That, of course, is the domain of the asset managers themselves. So we’re very thoughtful about ensuring that our training fits into all our clients’ investment thesis and processes. We also decided not to make a generic or even a general approach to ESG and risk but that we would look sector by sector. So we have assembled about ten different sectors, and we do a deep dive into the specific ESG issues for those sectors and what mitigation actions and mechanisms can be used for those portfolios. This won’t be a one-off engagement. We’re in this for the long haul. And so we offer a long-term helpline and continuous support and updates throughout the year to make sure our clients are kept updated in this fast-shifting ESG landscape, which sets us apart in enabling asset managers to integrate ESG into their systems.

Eveline Varin

Our training programme is that it’s a holistic solution for equity research departments. As Assheton said, the programme is delivered live rather than being an online download, and it is company-wide. So, we look at where all the analysts and portfolio managers are currently standing on the ESG. We work with them over the long run to understand the ESG regulations, why it’s important and how to integrate those. And what differentiates us from the other ESG training programmes out there is that because ESG issues and opportunities are sector-specific, we mirror the sell-side research structure by covering ESG integration for ten different sectors. And I think we’re the only ones to do that. The last point I wanted to highlight is that our trainers are fundamental equity research analysts themselves. So we understand the financial market, we understand the fiduciary duty of asset managers who are entrusted with investors with their money, we understand the risk-return payoff that they constantly need to assess. And when it comes to ESG, we understand the need to translate some particular issues into useful inputs that inform investment decisions. We are making this programme very practical. So for each of the sectors, we take three or four of the major companies within a sector and use them as examples of how to assess and integrate ESG into the forecast.

Agnes Davis

Is there anything on the horizon around this topic that our audience might want to be thinking about?

Assheton Carter

Asset managers should be looking at the tsunami of regulations which will be landing on our kind of corporate shores soon and are going to affect the portfolio companies. One service we offer is sending a monthly newsletter to update our subscribers on regulations and which sectors and commodities they affect.

Eveline Varin

Thinking as an equity research analyst, the next catalyst will probably be the EU carbon entry tax, also known as the carbon border adjustment mechanism. This is going to come into effect on 01 January 2026 and I think it will have a big impact on the cost of all European companies importing goods in Europe – they will need to buy carbon credits with the emission implied in the amount imported. This could have a signigicant impact on the cost structure of the companies and there will likely be winners and losers at that time. So I think this is something to watch out for.

Agnes Davis

Thank you so much for your time. It’s been really helpful to hear more about this in depth. Please feel free to get in touch with us – we’re here to answer questions and help with anything that you might have heard about that you’ve got further ideas around or you’d like to discuss.

You may also be interested in:

Does the investment impact the world, or does the world impact your investment? Exploring the differences between ESG investing and impact investing.

In today’s fast-paced world, businesses must adapt to the ever-changing landscape of investment and sustainability. TDi Sustainability recently sat down with Samuel Williams, Strategic Partnerships Lead for the Private Sector at Christian Aid, to discuss the differences between Environmental, Social, and Governance (ESG) investing and impact investing.

supply chain

supply chain

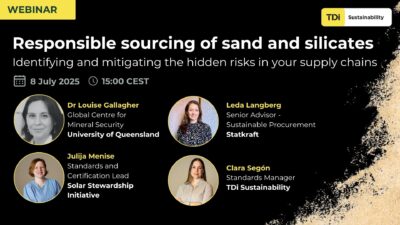

Responsible sourcing of sand and silicates | Identifying and mitigating the hidden risk in your supply chains

24th June 2025 supply chain

supply chain

Responsible sourcing of critical minerals for the clean energy transition – The Asian context

6th June 2025 Industry Initiatives

Industry Initiatives