Does the investment impact the world, or does the world impact your investment? Exploring the differences between ESG investing and impact investing.

In today’s fast-paced world, businesses must adapt to the ever-changing landscape of investment and sustainability. TDi Sustainability recently sat down with Samuel Williams, Strategic Partnerships Lead for the Private Sector at Christian Aid, to discuss the differences between Environmental, Social, and Governance (ESG) investing and impact investing.

Samuel shared valuable insights on how investors can make more informed decisions around sustainable business when aligning their financial strategies with corporate social responsibility (CSR) goals.

Defining “ESG Investing” versus “Impact Investing”?

Before delving into the differences between ESG and impact investing, it is essential to define these two concepts. ESG investing has its roots in the socially responsible investing that emerged in the 1960s, when investors began curating their investment portfolios on ethical grounds by excluding specific types of stocks or industries, such as tobacco products or investments that could be fuelling controversial political regimes.

The term “ESG” refers to evaluating and integrating environmental, social, and governance risks and opportunities into investment decisions. It is a holistic approach that considers the long-term impact of these factors on a company’s performance and resilience.

Impact investment sits on the spectrum from philanthropy through to high market rate return on investment, but with a consistent emphasis on high benchmarking to deliver a more targeted investment that intentionally seeks to generate positive, measurable social and environmental outcomes alongside financial returns.

“Investors who follow impact investing consider a company’s commitment to corporate social responsibility, or the duty to serve society as a whole positively,” Samuel explained.

Samuel Williams

Strategic Partnerships Lead for the Private Sector at Christian Aid

Key Differences between ESG Investing and Impact Investing

“One of the key differences between ESG and impact investing is the intent behind the investment. While ESG focuses on minimising negative impacts and mitigating against the risks that ESG practices of an investment may pose, impact investing actively seeks to create positive change.”

For example, an ESG investor might invest in a company that has a large and growing carbon footprint, so long as the “sustainability risks” incurred by investing in a high carbon-creating company are offset by other risk-reducing factors, such as price. If a stock is cheap, the ESG versus cost risk becomes low. It is also possible that ESG risk and ESG opportunity may offset one another with, for example, future quantifiable decarbonising activities, such as diesel-powered cobalt mining to enable the green transition.

ESG is currently primarily a risk matrix, interested in minimising negative impacts because they would negatively impact the financial return on investment. There may be less interest in the negative impact in and of itself.

However, this disparity is changing, and the Sustainability Disclosure Requirements (SDR) and investment labels regulations being released by the FCA are expected to increase transparency and disclosure around sustainable finance products and potentially inject a greater ‘purposefulness’ into the risk matrix, shifting from passive observation of ESG risks towards an active purpose towards net-zero (as well as Sustainability and Governance), although ESG is often more enviro-centric in practice.

Measuring ESG Versus Impact

Another significant difference lies in the measurement of outcomes.

Impact investment is primarily looking to achieve change and often willing to take a financial hit in order to do so. Impact investors typically set specific, quantifiable investment goals that can measure how change is being achieved, such as improving access to education or healthcare, increasing community investment, or providing tax relief for low-income families.

Whereas ESG investment is primarily looking to achieve financial return, perhaps through ESG opportunities, whilst avoiding the impact of a changing world in ESG risk terms. ESG KPIs, in contrast, are therefore often broad and principally assess the ESG risks and opportunities relating to financial returns.

The new SDR legislation is working to make this differentiation clearer, which has led to companies such as MSCI devaluing many of their ESG ratings on ETFs because they were found to be “selling” sustainable impact far beyond what they were actually achieving.

Gaps in Sector Applications

Samuel explained how ESG investing and impact investing can apply across various sectors that still require higher investment focus – such as infrastructure, agritech, transportation, plumbing and sanitation. He also emphasised the importance of identifying the right investment approach for each sector, considering each industry’s unique challenges and opportunities.

“In the agritech sector, an ESG investor might focus on a company’s water and energy usage, analysing the risks and opportunities associated with their practices which might impact a healthy return; while an impact investor would prioritise projects that address food security and promote sustainable farming practices in order to maximise social benefits, build capacity and recover a return on investment. Similarly, in the plumbing and sanitation sector, ESG investors might evaluate a company’s waste management strategies against the current and likely future legislative landscape, while impact investors would seek out projects that improve access to clean water and sanitation facilities for vulnerable communities.”

The Future of ESG and Impact Investing

As the world becomes more aware of the need for sustainable development, both ESG and impact investing are expected to grow significantly. Bloomberg estimates that a third of assets under management – c. $53 trillion – will be invested in organisations aligned to sustainable goals by 2025. Samuel believes that investors will continue to refine their approaches, seeking new ways to create positive change while generating financial returns.

Samuel also highlighted the importance of collaboration, particularly between the private sector and development organisations like Christian Aid, in driving greater impact. “The purpose of bringing different players in this landscape together is to discuss how we can fund and finance social development to unlock private capital in a way that is sustainable and doesn’t need aid dependency. By working together, investors and organisations can leverage their resources and expertise to address pressing global challenges more effectively.”

At TDi Sustainability, we understand the importance of aligning investments with corporate social responsibility goals. Our team of experts will help navigate the complex world of ESG and impact investing. We help clients make informed decisions by harnessing and maximising their digital data, ESG standards and management systems to benefit their community and the environment while generating healthy financial returns.

ESG Training for Equity Research Analysts

TDi Sustainability has teamed up with Denny Ellison, an expert in equity analysis and research training, to present a comprehensive and tailored ESG research and training programme for mainstream equity research analysts. This groundbreaking program delves into 10 unique sectors, setting it apart from typical ESG training initiatives. Throughout the 4-hour sessions per sector, analysts will participate in practical case studies featuring real companies, to gain vital skills in incorporating ESG factors and considerations into their research.

The program aims to address crucial challenges faced by equity research analysts in the ESG domain, such as interpreting data from external ESG research agencies and customising ESG analysis for specific industry sectors. Additionally, it focuses on seamlessly integrating ESG analysis into company forecasts, valuations, and investment cases.

What sets this training programme apart is its focus on examining ESG considerations on a sector-by-sector basis, offering tools and frameworks that empower analysts to integrate ESG into their fundamental research without dictating a specific responsible investing approach. Furthermore, the programme is led by a team of experienced trainers from TDi and Denny Ellison, including a sector specialist equity research trainer and an ESG expert.

After completing the ESG courses, each analyst will receive a certification that attests to their newly acquired skills and expertise, further solidifying their standing as informed and responsible professionals in equity research.

If you would like to learn more about how to participate in our ESG training for Equity Research Analysts, please reach out via [email protected].

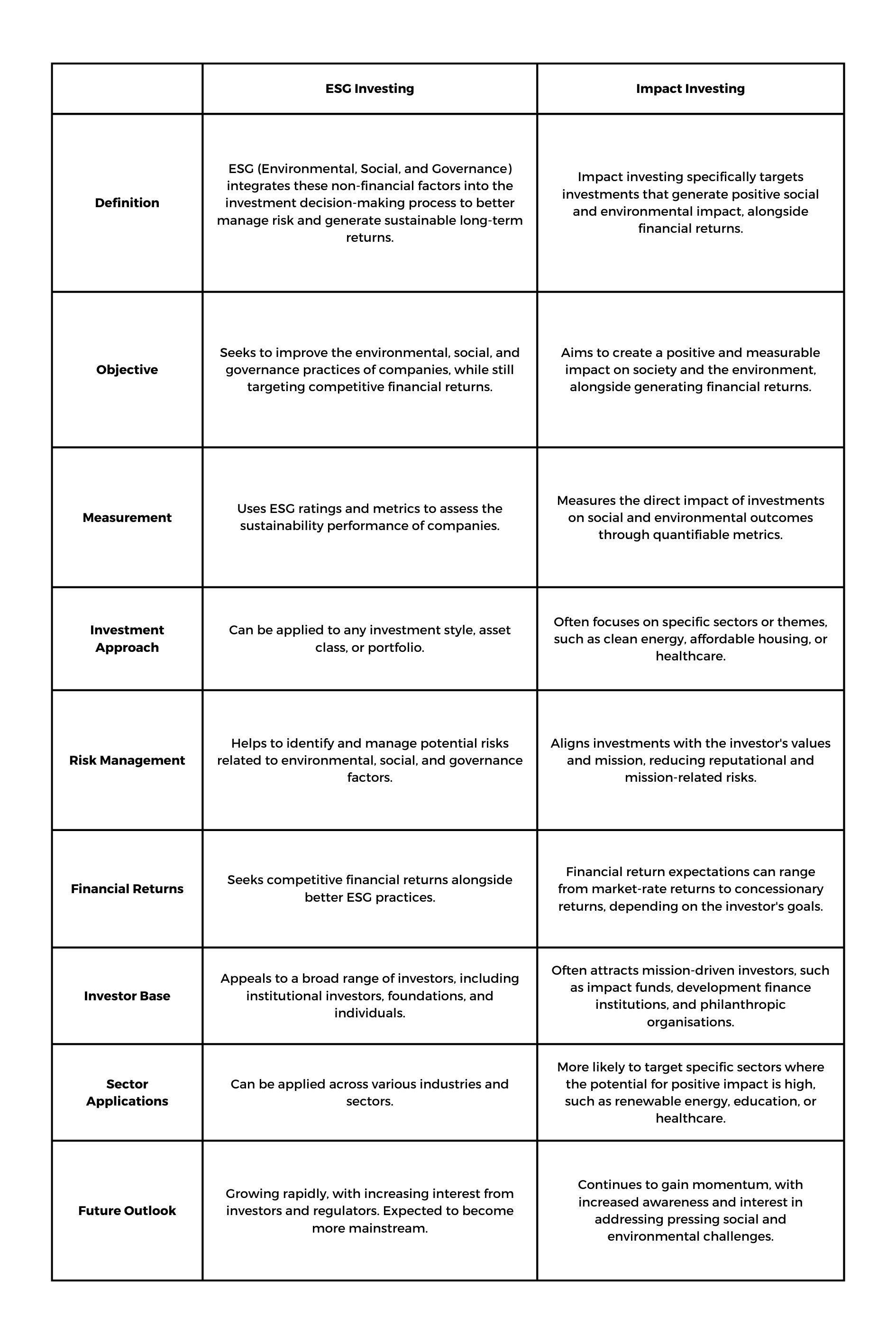

Comparison Table

This table shows the differences between ESG and impact investing for comparison purposes. However, in practice, there can be significant overlap between the two approaches, and many investors use a combination of both strategies to achieve their financial and impact goals:

You may be interested in:

ESG Investment Webinar Recording

Over the last few years, Asset Managers and Equity Research Analysts have been under growing pressure from clients to integrate ESG into their investment process.

This, combined with increasing regulations and the general recognition that ESG factors can affect risk and returns, has led more asset managers to include ESG considerations into their fundamental research and investment approach.

In this webinar, Denny Ellison CEO, Eveline Varin, was joined by TDi CEO, Assheton Carter, to discuss the key hurdles that analysts are facing, and present solutions to fill the skills gaps.

Automotive

Automotive

The Dark Side of Electric Vehicle Supply Chains – Understanding Free, Prior and Informed Consent

18th July 2024 Critical Minerals

Critical Minerals

What You Need to Know about Double Materiality and the Corporate Sustainability Reporting Directive (CSRD)

28th May 2024 Critical Minerals

Critical Minerals