TDi facilitates the integration of ESG factors into investment decisions and throughout the investment lifecycle. We develop bespoke tools that help portfolio companies assess and mitigate investment risks and identify opportunities. Our solutions can help you make well-informed decisions in a complex and ever-evolving landscape.

TDi services to support the finance and investment sectors, include:

Knowledge and training

Providing clarity and context on ESG investment through insights, reports and training for executives and staff on ESG trends, standards and regulations, and market and consumer demands and expectations.

Providing up to date information on ESG trends and developments and translate them into actionable improvements for funds’ capital deployment, investment activities, and oversight of portfolio companies.

Assessing and benchmarking companies against ESG regulatory and voluntary standards.

Development of management systems

Creating bespoke responsible investment and ESG due diligence management systems to support investment teams in making informed integrated risk assessments

Working with banks and funds to develop ESG risk appraisal tools and bespoke risk toolkits and appropriate monitoring and reporting frameworks for investments.

Developing bespoke methodologies such as the unique research valuation methodology created in partnership with Denny Ellison – helping financial analysts make informed decisions when carrying out research and investing in ‘sin stocks’

Developing performance evaluation criteria to support the investment team in assessing the financial impact of ESG initiatives in portfolio companies.

Audit and assessments

Conducting ESG audits on behalf of our clients to evaluate the performance, compliance, and quality of their portfolio companies, partners, or service providers.

Carrying out audits and assessments against investor-specific requirements, supplier codes of conduct, and a variety of key sustainability, traceability, chain of custody and responsible sourcing standards. This includes

assessments against IFC Standards and other financial institution safeguards

We conduct enhanced due diligence through targeted asset-level assessments, site visits and stakeholder interviews.

Find out more about our auditing services>

Monitoring risk

Monitoring portfolio risks and de-risking investment and finance

Utilising TDi’s unique digital tools to track real time ESG performance, voluntary standards and reporting frameworks

Establishing think tank groups, advisory committees, and multi-stakeholder initiatives, and providing updates on global markets, trends, opportunities and challenges in specific industries.

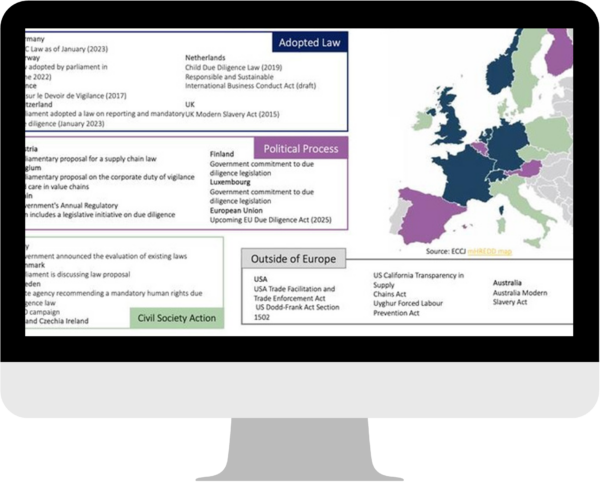

Tracking the tsunami of regulations to assist companies in navigating existing and emerging regulations on due diligence, responsible mineral supply chains, and conflict minerals.

Social impact investment strategies

Developing social impact investment strategies – helping companies to build social acceptance

Working with impact investors to evaluate the impact of their investments

Find out about how we help companies create a positive impact>

Communication

Developing customised communication strategies and programmes to enhance transparency with customers, potential investees and clients.

Case Studies

Development of a unique ESG valuation methodology to quantify the real value of ‘sin stocks’

TDi partnered with Denny Ellison, a London-based equity research and training organisation, to develop a unique ESG valuation methodology to quantify the valuation impact of ESG-related public allegations on companies that operate in sectors with significant ESG contention, or ‘sin stocks’. This work is summarised in the project report ‘The Real Value of Sin Stocks’.

Creation of a bespoke environmental and social risk management toolkit for trade and supply chain finance

TDi was asked by a UK-based financial institution to put together a bespoke toolkit for investors to use to effectively manage risk and unlock sustainable trade and supply chain finance opportunities to delivery positive environmental and social impacts. The resultant toolkit evaluates the risk exposure of more than 200 commodities across high risk categories. It can be used at different stages of the investment process and lifecycle, including due diligence, monitoring and benchmarking.

TDi Search 360

TDi developed the Search 360 digital tool to aggregate, analyse and monitor information on supply chain risk for specific countries, materials, locations, businesses, initiatives or projects. Search 360 provides a holistic perspective on potential sustainability issues related to your portfolio companies. It combines cutting-edge technology with in-depth human analysis to help develop strategic solutions for your business.

ESG trends in investment and finance

DUE DILIGENCE

ESG factors are now a ‘must’ in due diligence and adverse news monitoring – providing information to investors to comply with regulations, make informed risk-based decisions, and identify opportunities to realise long-term value.

COMMODITY SUPPLY CHAINS

Markets are seeing increasing fluctuations in commodity prices from interruptions to supply chains and geopolitical tensions. This includes physical commodities and hard assets such as minerals and metals, energy commodities, and agricultural products as well as financial instruments like currencies and bond yields.

CLIMATE CHANGE AND NET ZERO

Increased regulatory and stakeholder demands have triggered many investors to search for ‘Paris-aligned’ and low-carbon/decarbonised deal flow without foregoing portfolio quality – developing strategies that reduce risk while grasping durable investment opportunities.

THE CLEAN ENERGY TRANSITION

There is rising awareness of the ESG issues associated with the surging demand for minerals for clean energy technologies and land required for renewable energy projects.

Find out more in TDi’s latest report: Material Change for Renewables

Contact us

Fill in the below form and we’ll contact you directly.

Get in touch to find out how we can help your business adapt to the evolving market environment, understand the unique challenges and risks associated with emerging niche markets, and achieve long-term success.

– Social impact investment strategies

– Development of bespoke risk toolkits

– ESG audits and assessments

– Adverse news monitoring

– Enhanced due diligence

– Training for executives and staff

Connect with us on LinkedIn

For the latest news, data and insights from TDi Sustainability and their associates.