Changes to the EU Batteries Regulation | Why effective due diligence strategies can’t wait

On 21 May 2025, as part of a fourth omnibus package of measures to simplify rules and reduce bureaucracy across the Single Market, the European Commission published a proposal to amend the European Batteries Regulation.

What is the EU Battery Regulation (EUBR)?

The EUBR imposes due diligence obligations on economic operators placing batteries on the market or putting them into service. These obligations cover the sourcing, processing and trading of cobalt, natural graphite, nickel and lithium for battery manufacturing. The Regulation aims to contribute to the efficient functioning of the internal market, while preventing and reducing the adverse impacts of batteries on the environment. It also aims to protect the environment and human health by preventing and reducing the adverse impacts of the generation and management of waste batteries.

Why the changes?

The EU Commission has identified a number of reasons for the changes proposed to the EUBR under the fourth omnibus package:1

- Only about half of Member States have so far appointed a notifying authority to assess the battery due diligence policies of economic operators

- No standard has yet been identified for the accreditation of these notifying bodies for battery due diligence

- The Commission requires time to assess the changes made to the Corporate Sustainability Due Diligence Directive (CSDDD) as a result of the EU Commission’s first and second omnibus packages of changes, in order to develop guidelines for both pieces of legislation hand in hand

- The economic imperative to ease the transition of companies scaling up from Small and Medium Enterprise (SME) status and reduce the compliance barriers attached to scaling up

What changes have been proposed?

- A delay in enforcement of due diligence requirements under the EUBR of two years to August 2027. This is to provide more preparation time for economic operators and to allow time to resolve difficulties in the availability of notifying bodies

- A new category and definition has been introduced for mid-cap companies (SMCs), raising the level at which a company qualifies as an ‘economic operator’ from €40 million to €150 million in annual turnover. Both SMEs and SMCs will now be exempt from the rules on due diligence and tracing back supply chains of battery raw materials2,4

- Product information can now be provided in digital format so that consumers can access this information directly online3

- The frequency of public reporting for all companies in scope of the EUBR has been reduced from yearly to once every three years4

- The EU’s due diligence guidelines for the Batteries Regulation will now be published in July 2026.

The aim of the proposed modifications to EUBR, as with the first and second omnibus packages of changes to EU sustainability regulations, is to subject companies to a due diligence framework that is less complex and costly and more harmonised. However, it is unfortunate to see the Commission stripping the Green Deal of some of its key provisions rather than doubling down on support to companies in scope. While the proposed changes do not amend any substantive rules of the Batteries Regulation, the delay reduces the urgency with which the Green Deal is being delivered.

“There’s a risk that continued delays could undermine the very strategy of the EU and its desire to be a trusted and predictable haven to carry out responsible, reliable and innovative business” says TDi CEO Assheton Carter. “These recent announcements (including the latest around the EU Batteries Regulation) could put businesses that have invested much to meet shifting societal values towards cleaner, greener and fairer operations and supply chains, at a competitive disadvantage.”

What do the changes mean for your company?

Even though the changes to the EUBR delay the anticipated compliance and reporting burden on companies, and reduce the number of businesses in scope, the reputational, supply surety and political risks to companies linked with human rights, climate change, environmental, governance, price volatility and geo-political issues remain. It’s therefore imperative that companies don’t just act reactively to regulatory delays, and slow down their due diligence efforts, but evolve and lead the way in producing strategies that align with stakeholder expectations and deliver long term business resilience and success.

Over the last ten years, TDi has consistently seen that supply chain due diligence and the integration of sustainability thinking into strategy makes companies more resilient and competitive by enabling them to understand exposure to sourcing risk.

TDi has built its in-house expertise and digital management tools to help our clients to understand and manage multiple types of supply chains risks and enable their businesses to navigate an uncertain future.

Large companies in scope of the EU Batteries Regulation

Get in touch for a free 30-minute consultation to discuss what you need to do to get ready for the new deadlines. Don’t delay – make sure you’re putting in place the frameworks to comply with the 2027 deadline now.

Ensuring readiness for the EUBR will also ensure that your company is well prepared for other sustainability regulations and disclosure requirements. It can also help to improve corporate reputation and access to capital as stakeholders increasingly expect solid sustainability credentials.

Companies that fall into the new ‘mid-cap’ definition

Although you may now be out of scope for the EUBR, supply chain due diligence is still essential to understand your exposure to sourcing risk, increase your business’s future resilience and competitiveness, and meet stakeholder expectations around environmental and social impact.

Voluntary reporting can also help to provide access to sustainable financing opportunities, as well as improving your business’s preparedness for future regulations and voluntary sustainability standards. Get in touch for a free consultation to discuss how TDi can help you identify and mitigate risk in your supply chains.

4 https://ec.europa.eu/commission/presscorner/detail/en/qanda_25_1278

supply chain

supply chain

Re-defining legacy | Supporting companies and investors in achieving positive legacies in mining operations

3rd July 2025 supply chain

supply chain

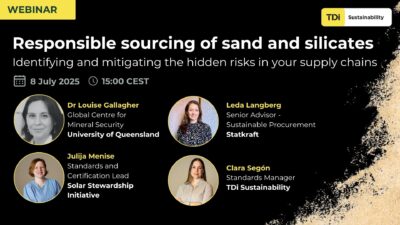

Responsible sourcing of sand and silicates | Identifying and mitigating the hidden risk in your supply chains

24th June 2025 supply chain

supply chain